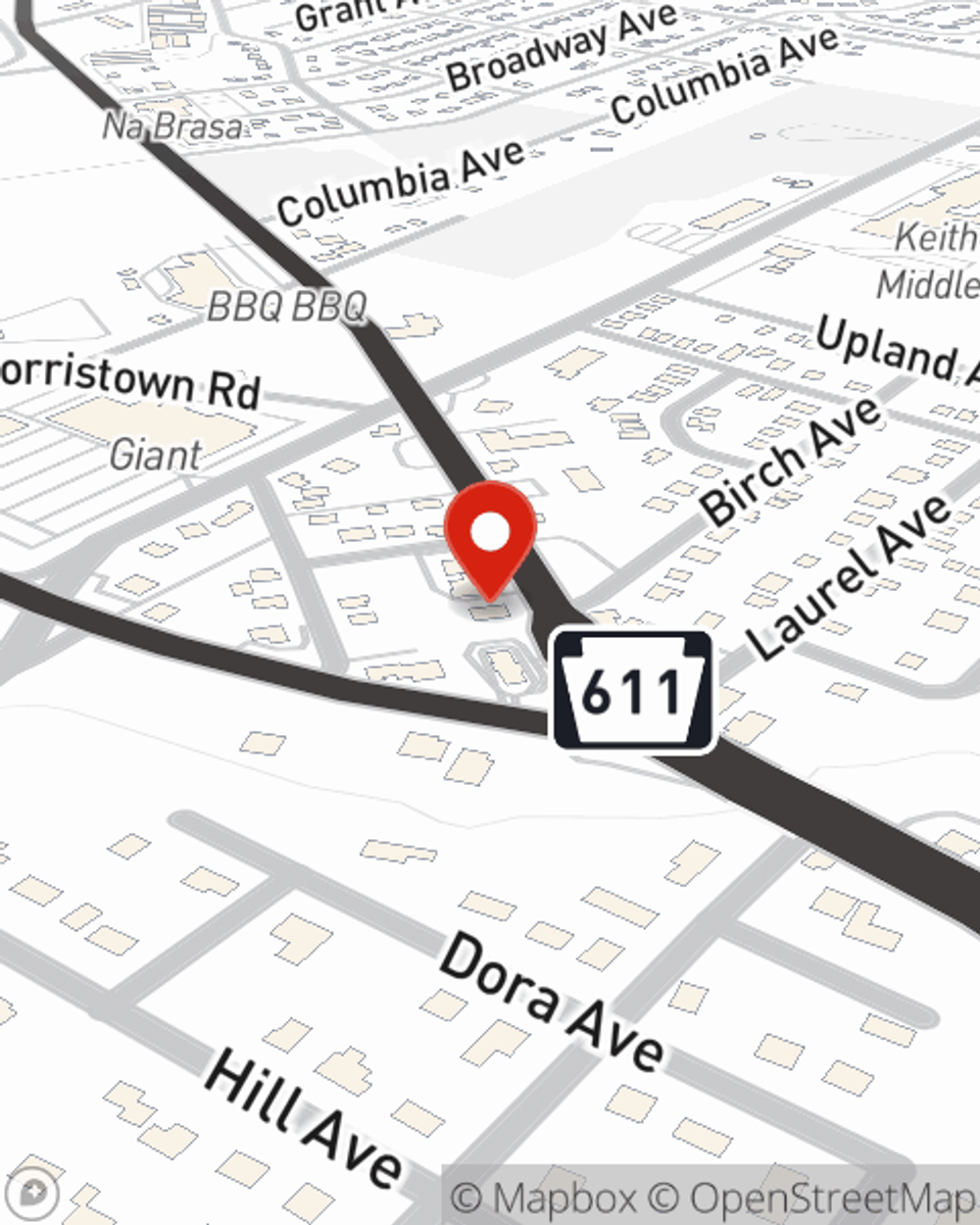

Business Insurance in and around Horsham

One of Horsham’s top choices for small business insurance.

Insure your business, intentionally

- Horsham

- Hatboro

- Philadelphia

- Glenside

- Doylestown

- Warrington

- Warminster

- Ambler

- Willow Grove

- Abington

- Huntingdon Valley

- Churchville

- Richboro

- New Hope

- Perkasie

- Lansdale

- Montgomery County

- Bucks County

Coverage With State Farm Can Help Your Small Business.

Sometimes the unanticipated does occur. It's always better to be prepared for the unfortunate accident, like an employee getting injured on your business's property.

One of Horsham’s top choices for small business insurance.

Insure your business, intentionally

Keep Your Business Secure

Protecting your business from these potential catastrophes is as easy as choosing State Farm. With this small business insurance, agent Lisa Kozak can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Intrigued enough to research the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Lisa Kozak today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Lisa Kozak

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.